Preparing Your Home For Fall & Winter

As the weather begins to cool and the leaves start to change, many people start thinking about how they can prepare their homes for the change in seasons and upcoming colder months. Taking the time to properly prepare your home for seasonal changes is a great way to check if there are any repairs that need to be made or equipment that needs to be replaced before the snow settles in.

If you’re wanting to prepare your home for fall and winter but aren’t sure where to start, we’ve put together this blog post to help you out.

Clean Your Gutters

To avoid running into blocked gutters during the spring snow melt, taking the time to clean out your gutters in the fall is a great way to get rid of any debris that might cause issues down the road. Things such as leaves, twigs, and other debris that get blown around have the potential to clog up your gutters and downspouts, so being proactive and cleaning them routinely will help keep them clear and avoid potential water damage to your home.

Test Winter Tools & Equipment

There is nothing worse than waking up to the first snowfall of the year, only to find that your snowblower isn’t working properly or your snow shovel isn’t where you thought you left it last year. Taking the time to test your winter equipment in the fall months is a great way to ensure that when the snow falls, you can efficiently clear it from your sidewalks and driveways. It might also be a smart idea to install any Christmas lights before the snow begins to fall.

Clean & Store Outdoor Patio Furniture

While it might be tempting to just pull in the cushions from your outdoor patio sets for the winter, it’s always a good idea to give your outdoor furniture a thorough cleaning before the cold months set in. It is also recommended that you store your furniture properly to help minimize the environmental wear and tear that comes with cold Canadian winters.

Drain Outdoor Faucets

Before the cold winter months set in, it’s always a good idea to disconnect any outdoor garden hoses and drain outdoor faucets. This will help prevent any water that may be stuck in the pipes from freezing and potentially damaging the water pipes within your home. In some instances, you may want to look at installing outdoor faucet covers to help protect them from the cold winter elements.

Whether you’re a first-time homeowner looking to protect your new home from the elements or looking to establish more of a fall/winter maintenance routine, following these steps will help you better prepare your home for the upcoming cold weather.

Are you looking to buy your first home? We can help! Contact Max Carbone today to be put in touch with one of our experienced real estate agents.

How Are Property Taxes Calculated?

How are property taxes calculated?

It is January, the start of a new year, and everything is fresh, covered in pillows of white snow and you have wandered out to grab your mail and find your BC Assessment Notice. You open the letter, and your eyes scan quickly to the middle of the page to find the assessed value and the percentage increase from last year until now. WOW! You cannot believe your eyes, a 48% increase in value (this is what I saw on my property assessment this year!).

Now, if you are thinking of selling your home, this is fantastic news, you just doubled your money and equity from last year, right? Not quite. And if you were thinking about staying in your home, does this mean that your property taxes just went up by 48%? Not quite on that front either.

Here is what you need to know about what the BC Property Assessment means for a. market value if you’re thinking of selling, and b. your property tax bill if you are thinking of staying in your home. Firstly, what does your BC Assessment mean in relation to the market value of your home if you are thinking of selling? Assessment values DO NOT equal market value. The BC Assessment Authority is an independent organization that determines the assessed value of your property based on grouped data, the median price value and determines values at one point in time, July 1st of each year. Grouped data means that they pull data for homes with similar characteristics, such as location, view, size, age, beds, baths, garages, recent similar sold data in the area, etc., and lump all those homes into a similar group and then look at the median value.

Often this means that the individual homes and characteristics are not accounted for in determining the specific value of one home because there are not enough bodies to physically go and walk through every home in the province. Think of the assessed value as more of a general value of what some homes of similar specifications might be valued at in a specific area, but YOUR actual market value could be higher or lower depending on the condition of your specific property. You will often find variation between your assessment and your neighbors, and between homes that you know are the same as yours that have recently sold. Having said that, your assessment value should not be dramatically far off from the market value (plus or minus either side) and the best way to determine true value is to get in touch with your REALTOR® to have a comprehensive market analysis done for your specific home.

What if you are not selling your home and want to know how this incredible jump in property assessment is going to affect your annual property taxes? Well, good news, you can breathe a sigh of relief, a 48% increase in property values does NOT mean a 48% increase in your property taxes. Phew!

In January, you get your assessment in the mail, which tells you what the BC Assessment thinks your property WAS worth ON JULY 1st of the previous year, your property classification (ie. Residential, farm, commercial, etc), and any tax exemptions you get (ie. homeowner grants, old age exemptions, etc.).

In the early spring, your local taxing authority (regional, municipal, township, etc) sets its property tax rates for each of the nine property classes that the BC assessment categorizes all homes into and then applies the applicable tax rate, also known as the “mill rate”.

The mill rate is determined based on your taxing authorities’ annual budget and how much revenue they need to raise to cover the budget that year and it must be set before May 15th. If you want a say in your property taxes and the mill rate, you might consider getting more involved in following your local authorities’ budgets each year.

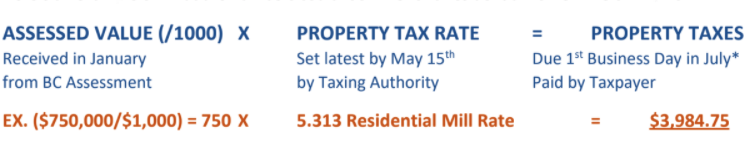

There is a different “mill rate” for each of the nine BC Assessment property classes and, since BC Assessment is a third-party organization, it has no part in setting the property tax rates. Local property tax rates are applied to each $1,000 of taxable assessed value; a higher assessment equals higher taxes.

Here’s an example of what the numbers could look like for a residential home in Kelowna, BC:

So, while an increase in property value does not equate to the exact same percentage increase in property taxes, it does, inevitably, mean an increase in your annual costs, if we assume that your municipality has an increasing annual budget and not a decreasing one.

I hope this blog helps to clarify what your BC Assessment means in relation to the current real estate market, to your property tax bill and alleviates some of your concerns about any huge spikes in your annual property taxes. If you would like to know the details of how your local authority sets the mill rate for each property class, you can take a deeper dive into that subject on the BC Government site by clicking HERE or connecting with your local municipality’s taxation department.

Justina LeeStolz

REALTOR®, Personal Real Estate Corporation

CENTURY 21 Assurance Realty Ltd.

View more Blog Posts

Easter Seals BC/Yukon: Drop Zone 2021 Video

– Check out our Youtube page or explore More Blog Posts

Why Is Kelowna So Popular?

Why is Kelowna so popular?

Kelowna is a very entrepreneurial environment and it’s based on multiple industries and activities. Obviously, there’s the agriculture, there’s the wineries, the tourism activities, but we also have a strong aviation industry.

Watch to learn more!

Check out our other Blog Posts or take a look at our YouTube Page for more videos like this one.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link